Orane’s Tax Solutions

Taxation on the Go!

Simplify your approach to tax controls by regularly monitoring transactions and centralising remedial processes, and increase compliance. Integrate automation to aid in the speeding up of audit-proof repairs and adherence to new digital regulations. The need for SAP Tax Solutions comes from inefficient tax administration processes, reconciliation and fraudulent invoices. Create an enterprise-wide tax control repository and automate the screening of all tax-related transactions. Get audit-proof corrections and automated remediation through machine learning in one centralised platform.

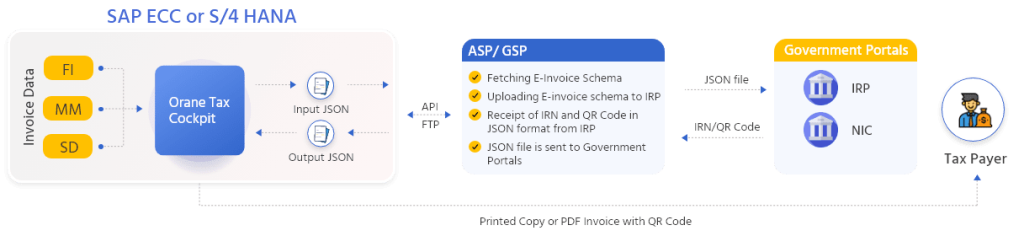

What is E-Invoicing?

E-invoicing is a system through which B2B transactions are authenticated electronically by GSTN for further use on the common IRP portal. A unique IRN number is generated. GST System will also then generate Return as well as e-way bill from this data. The major pros that e-invoicing delivers are transparency and proof.

Type of Documents covered under e-Invoicing

Our solutions

We offer a range of services in our Tax Cockpit

GSTIN Validation

Our GSTIN Validation service helps you create, change, and update your vendor’s GSTIN details directly through our user-friendly cockpit. You can also block or unblock GSTIN details and check your vendor’s return filing history and status. We even offer a custom table to store vendor details received from the API and a JSON response download functionality.

Vendor Reconciliation

Our Vendor Reconciliation service helps you reconcile all your vendor-related invoices through our cloud solution. You can push and pull invoices from the cloud, and we maintain three reconciliation statuses for you – Not in GSTN, Mismatch, and Reconciled during the Period.

GSTR 2A/2B/6A

Our GSTR 2A/2B/6A service displays data related to your invoices, suppliers, and ITCs through a dynamic ALV grid, separately for each data type. Our extraction program has pull and delete frequency options, and we offer a JSON response download functionality.

TDS Register

Our TDS Register service includes two registers – inward and outward – to keep track of TDS transactions related to vendors and customers. We maintain an ALV grid to showcase your TDS data, and we reconcile any gaps through file pushes to the cloud. You can even differentiate between TDS and TCS invoices through our radio button functionality.

TCS Register

Our TCS Register service enables you to maintain an electronic record of all transactions in which TCS is applicable. With our easy-to-use cockpit, you can track and monitor all TCS-related transactions, including details such as the supplier name, TCS rate, and TCS amount.

Export and Import

Our solution also supports export and import of data, making it easy for you to share and transfer data between different systems. With our export functionality, you can extract data in multiple formats such as Excel, CSV, and PDF. Our import functionality enables you to import data from external sources, reducing manual data entry and improving data accuracy.

Orane for E-Way Bills

For the movement of products, an E-Way Bill is an electronic way bill that can be generated on the E-Way Bill Portal. A GST registered individual cannot move goods in a vehicle with a value over Rs. 50,000 without an e-way bill filed on government website for e-way bill. An E-Way bill can also be generated or cancelled using an SMS, Android App, or API site-to-site interface.

Each E-Way bill is granted a unique E-Way Bill Number (EBN), which is available to the provider, recipient, and transporter. An Automation of E-way Bill number into the Invoices by integration with NIC Portal, provides statistics and alerts.

Tax Solutions Overview

Easy, Quick and Reliable

Create E-invoices, advance receipts, credit & debit notes, reverse charge E-invoice within SAP

Generate E-Way Bill together with E-Invoice with user intuitive and easy-to-use SAP Cockpit

Generate your Tax Returns & automate GST Reconciliation (Inward/Outward)

Digital sign invoices, purchase order and debit/credit notes and archive in the seamlessly integrated DMS/Content Server

Use RPA to automate your complete vendor invoice management

Automated remediation through machine learning

Reconciliation

To filter transactions related to tax and enable remediation, connect with other business solutions such as your ERP, billing, or payment processing software. R1, R2 and 3B Tax Reports are generated in real-time.

Analytics & Reports

Compliance, Fraud, Finance and Operations are various analytical indicators as given below:

Compliance

- Split Purchase Order

- 3-way Match Analysis

- Invoicing without GRN

- Data Visibility and management

Fraud

- Duplicate Vendor Invoices

- Employee as Vendors

- Duplication of Vendors

- One-time Vendor Analysis

Finance

- Large Non-PO Invoices

- Share of Business (Vendors)

- Payment Terms Mismatch

- Debit note analysis (High Value)

Operations

- Price Variation Analysis

- Open Purchase Orders & GRN

- GR-based Invoice Verification

- Payment without POD

Why Us?

Transparent

Professional Expertise

Data Confidentiality

Maintenance & Regulatory Updates

24/7 Customer Support

Success Stories

Indian Express GST Implementation Case Study